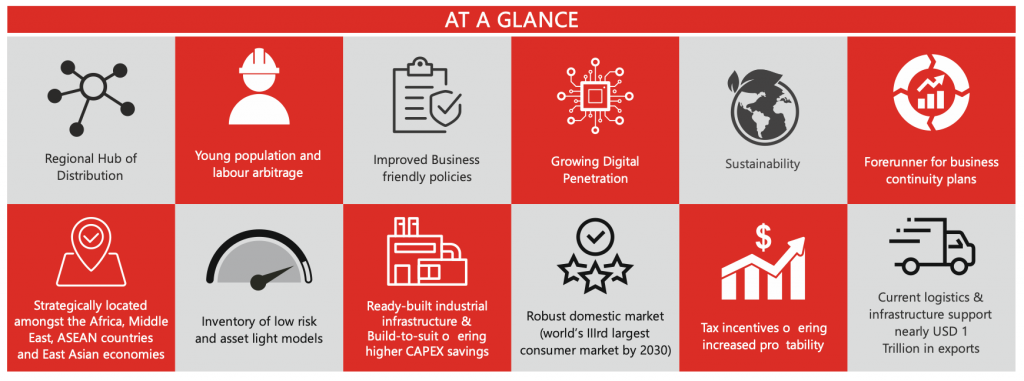

While the entire world has gone through some disruptive changes because of the pandemic, it has also opened a window of opportunity for India. Poised to become the world’s third-largest consumer market within the next decade, India can safely be categorized as a growth engine for the foreseeable future. Regionalization of manufacturing supply chain (Make in India 2.0) and strengthening of domestic manufacturing base (Atmanirbhar Bharat) makes India a global or regional hub in manufacturing. India’s unprecedented rise in the World Bank’s Ease of Doing Business Rankings 2020 to #63 (2019 – #77, 2014 – #142) is a testament to its persistence, drive, and effort to become the world’s business destination of choice.

It has emerged as a forerunner for business continuity plans, with its inventory of low risk and asset-light models like ready-built industrial infrastructure and build-to-suit offering higher Capex savings, new tax incentives offering increased profitability, and a domestic market comprising 18% of the world population. India continues to make a mark on the world map as a manufacturing destination and is home to several major global manufacturers from diverse sectors. Most states have created single-window mechanisms to grant permissions within the stipulated time and have set service level agreements to grant permissions within 30 days, with provisions for deemed approval in cases of deviation. Information about industrial parks with plot-level details is being provided through GIS platforms.

India has one of the most attractive corporate income tax rates for manufacturing and services investments. A special window for manufacturing investments is open till 31 March 2023, with an attractive corporate income tax rate of 17.16%.

Emerging Engine for Global Manufacturing

- Forerunner for business continuity plans

- Strategically located amongst Africa, Middle East, ASEAN countries and East Asian economies

- Inventory of low risk and asset-light models

- Ready-built industrial infrastructure

- Build-to-suit offering higher Capex savings

- Robust domestic market {(World’s IIIrd largest consumer market by 2030 (18% share of the global population)}

- Tax incentives offering increased profitability

- A young population and labour arbitrage

- Improved business-friendly policies

- Top 10 recipients of overseas investments in 2019

Post Pandemic opportunities and alternative business continuity plan – COVID 19

- Reduction of corporate taxes for setting up of new industries (lowest among the MITIV countries)

- Host to Global In-house Centres (GICs) and Global Centre of Excellence (GCoEs) for several manufacturing companies that provide for more robust ecosystem and R&D

- The added attraction of a large domestic market along with prospects of a manufacturing export hub.

Asset-Light & Low-risk Innovative models

- Ready built infrastructure

- Faster industrialization – Speed of Execution

- High-End Specifications (Pre-constructed/Ready infrastructure)

- Built-to-Suit Plinth Ready and ground-up construction

- Higher CAPEX savings – Rented factories for lease